Tax has a significant impact on the returns of your investment. If, like most of us, you would like to see more return in your account and less in the hands of the tax man, it is important to engage with the details and understand which product is best for your circumstances. If you don’t need immediate access to your money, it is worthwhile taking advantage of the incentives the government has put in place to encourage us to invest for the long term. These incentives can be very attractive, particularly when you look at how the value compounds over time. Jeanette Marais and Richard Carter discuss how taxes are applied in different investment products and how this ultimately impacts your investment returns.

Numerous studies have been conducted globally looking at people’s attitudes towards paying tax and the question of why people pay or evade tax has received much attention. While the studies come from different standpoints and cover quite a lot of moral ground, there is a common thread: most people don’t like to part with their hard-earned money, even if it is for the greater good of society.

With this in mind, it is understandable why investors often ask us which investment products are most tax efficient. While we are not tax advisers, and would suggest you contact your independent financial or tax adviser for advice specific to your circumstances, we can offer some perspective. Note that this article quotes tax rates applicable for the 2016/2017 tax year and applies to individuals investing in their own personal capacity.

First let’s face the facts: you are always going to pay some tax at some stage of the process. Most of the time you will be investing with money you have already paid income tax on. In the case of retirement products, you invest with pre-tax money, but your tax is deferred to retirement or withdrawal stage. Let’s take a high level look at the local investment products available to you through Allan Gray, and the impact of tax on your investment return.

It makes sense for most people… to put their first

R30 000 into a tax-free investment account

Tax in a unit trust

Unit trust investments are the most flexible of all products as they don’t have any contribution or withdrawal restrictions.

You invest in a unit trust with after-tax money and then pay tax on interest, dividends and capital gains. Interest is taxed at your marginal tax rate and dividends are taxed at 15%.

You also pay capital gains tax (CGT) when you withdraw from unit trusts. Forty percent of the capital gain is taxed at your marginal tax rate, but your first R40 000 per year is exempt. You do not pay capital gains tax when your investment manager buys and sells underlying assets within the portfolio. You experience a capital gain or loss on unit trust investments only once you sell the units (when you switch between unit trusts or withdraw).

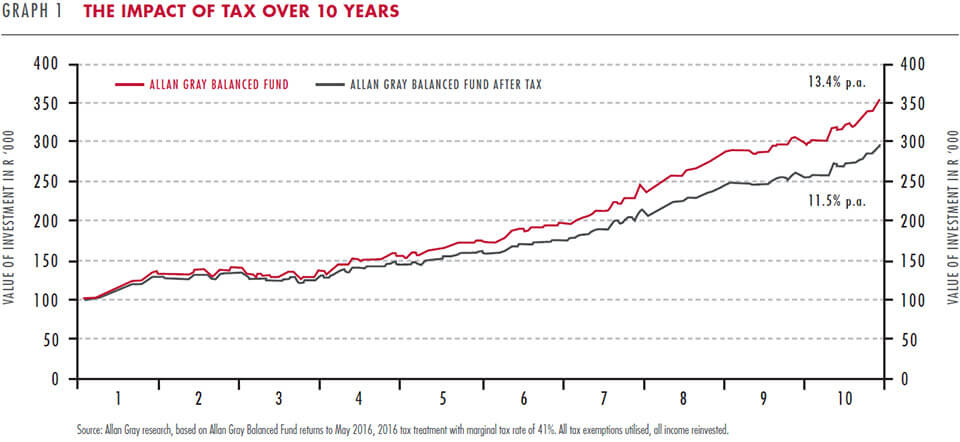

Graph 1 illustrates the impact of tax on your investment return in the Allan Gray Balanced Fund over time. The red line illustrates the 10-year return as reported on the Balanced Fund’s factsheet, while the grey line reflects the return an investor would receive after tax – although this would be different for everyone as it is based on your personal tax rate and circumstances; the graph reflects the worst case scenario. Note that under this relatively reasonable set of assumptions, around 2% of the growth is lost to the tax man each year, which means your investment is worth 16% less at the end of 10 years based on today’s tax rates.

Tax-free investment accounts provide a decent alternative (but note the restrictions).

If these figures leave you wondering how you can earn a similar return but not suffer the tax sacrifice, the government has delivered a great alternative with tax-free investment (TFI) accounts. These were introduced last year and we launched ours in February. While, as with a unit trust investment, you invest in a TFI account with after-tax money, all income and dividends are tax-free and you pay no CGT when you withdraw.

There is a catch. The maximum amount you can invest is R30 000 a year with a lifetime maximum of R500 000. If you exceed these limits you will incur a 40% penalty on the excess amount. It makes sense for most people investing for the long term (but who want ready access to their money) to put their first R30 000 into a TFI account.

If you can handle the restrictive rules, endowments are another option

If you are a high income earner, you can benefit from a favourable tax rate if you invest in an endowment. An endowment is a policy issued by a life insurance company, such as Allan Gray Life. When you invest in an endowment you effectively swap your tax position for that of the policy. The big deal here is that for higher tax payers, instead of paying tax at 41%, you pay tax at the rate that the life company must apply, which is 30%. The downside is that the life company can’t give you your exemptions – so you pay tax, albeit at a lower rate, on all of the interest income and capital gains. Dividends are subject to 15% dividend withholding tax irrespective of your country of residence. Endowments have restrictive rules regarding contributions and withdrawals, and should only be considered if you are willing to lock your money in for five years.

Retirement annuities win on the tax front

The product that offers the best tax benefits is the retirement annuity (RA), however, it also comes with the most onerous restrictions on withdrawal. Note when considering an RA that you are buying a product for life because you will have to use two-thirds of your investment to buy a product that can pay you an income when you retire (such as a living annuity or guaranteed life annuity).

As with a TFI account, in an RA you pay no dividend tax, income tax on interest or CGT. Because you are compounding all gains tax free, your investment value at the end of 30 years could end up far higher than in a discretionary unit trust investment.

The main difference between the two products is that an RA offers tax savings now, i.e. you pay less tax now because you make contributions with earnings on which you have not paid tax, but you will pay tax later, i.e. you defer paying tax.

As of 1 March 2016 RA investors are allowed a tax deduction of up to 27.5% of taxable income, capped at R350 000 per year. This is a solid increase from 15% previously and makes the tax savings on an RA more relevant for higher income earners (albeit less so for the very high earners where the new annual rand cap is less than the previous 15% limit).

Apart from deferring tax in an RA, an additional tax saving comes from paying a lower average tax rate on the benefits withdrawn from the RA at and after retirement, versus the tax saved on contributions. The first R500 000 lump sum you withdraw from your RA is currently tax free (importantly, this amount includes any pre-retirement withdrawals you may have made from any other pension fund investment).

As noted above, you must transfer the rest of your benefit to an income-providing product. When you pay income tax on this benefit, you are likely to be taxed at a lower rate than when you were making contributions, which is where the additional tax saving comes in. Because of this, a disciplined investor can make a significant tax saving over their lifetime. The amount saved varies greatly depending on each investor’s personal circumstances, salary, age, how much and how long they have saved, any withdrawals made along the way, as well as their tax situation in retirement.

Fit for purpose

But what does all this mean in rand terms?

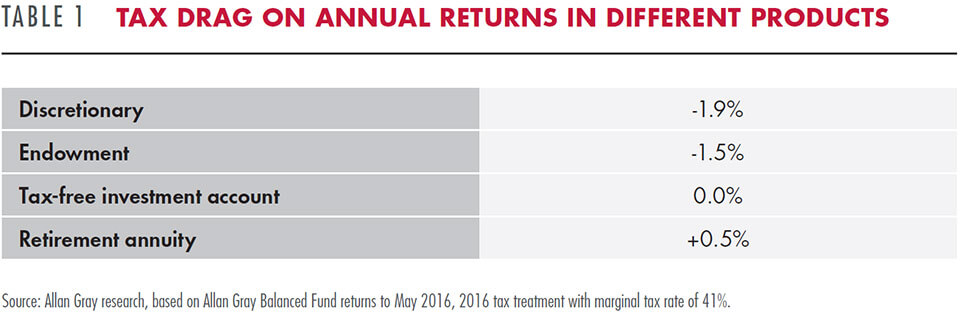

Table 1 illustrates the impact of tax based on a 10-year investment in the Allan Gray Balanced Fund across our different products. The table is illustrative and ignores various product restrictions. As with graph 1, the analysis assumes that the investor has used all their allowances and is liable for the full tax as appropriate. The tax drag shown is the extent to which the after-tax returns based on the most recent 10 years of the Balanced Fund would have lagged the gross returns of the Fund. A cursory glance at the table suggests that it would be short-sighted not to consider an RA where the tax savings would have resulted in a boost to returns rather than a drag.

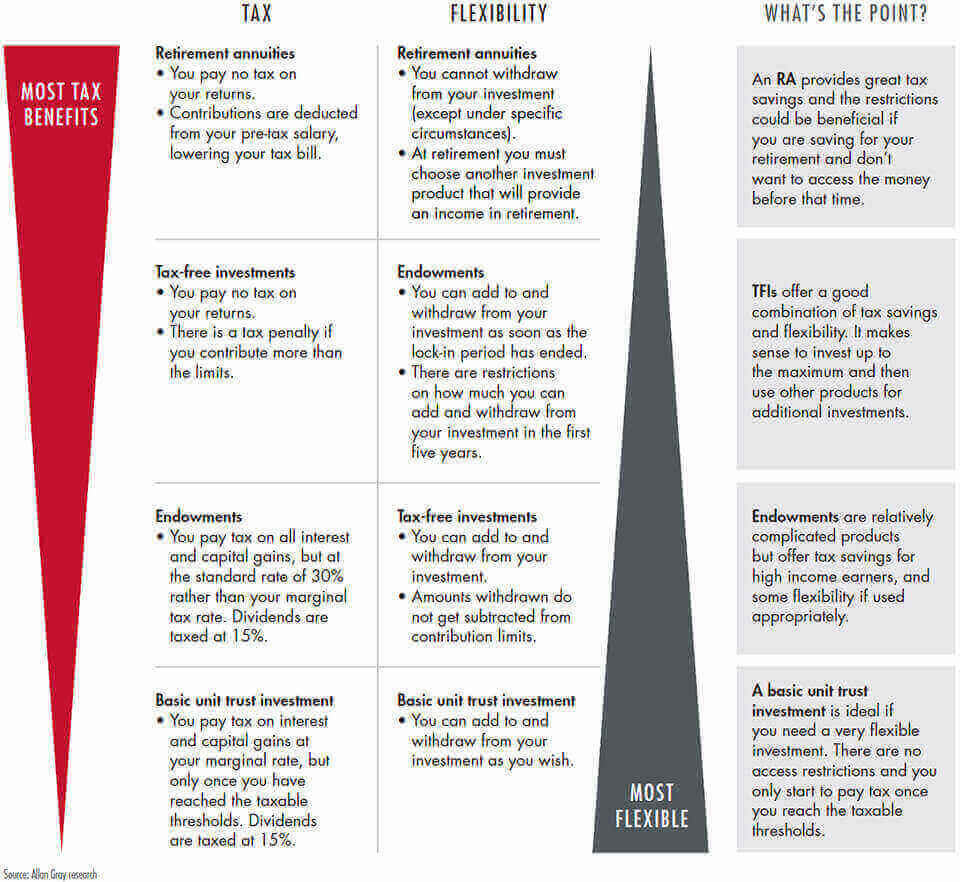

Bear in mind that you cannot simply choose a product based on its tax benefits as other characteristics may make the product unsuitable. The graphic below offers a summary of the key factors to consider when selecting a product.

Consider getting advice

Working out which product is the most tax-efficient and appropriate for your circumstances can be complex. It is worthwhile talking to your independent financial adviser or tax adviser for more information to make sure you make the best decision for yourself.

Some investors have asked us if it is possible to do a unit transfer from a discretionary investment into a retirement annuity – without incurring capital gains tax. Unfortunately this is not legally possible. A discretionary unit trust is structured differently to a retirement annuity and one would have to withdraw from your unit trust investment and pay the capital gains tax before re-investing the money in your RA.