The Minister of Finance announced amendments to tax and other legislation that may affect investors. These changes, which come into effect on 1 March 2016, are discussed below.

INCOME TAX

Individuals and special trusts

The highest marginal tax rate for individual taxpayers remains unchanged at 41%. The personal income tax rates for the 2016/2017 tax year are listed below.

Companies and trusts

The income tax rate for companies remains unchanged at 28% and at 41% for trusts (other than special trusts).

TAX THRESHOLDS

Tax thresholds have been increased to:

- R75 000 for taxpayers younger than 65

- R116 150 for taxpayers aged 65 to below 75

- R129 850 for taxpayers aged 75 and older

REBATES

The primary rebate (deductible from tax payable) has been increased to:

- R13 500 per year for all individuals

The secondary and tertiary rebates remain unchanged at:

- R 7 407 for taxpayers aged 65 and older

- R 2 466 for taxpayers aged 75 and older

INTEREST EXEMPTIONS

Interest exemptions remain unchanged:

- The exemption on interest earned for individuals younger than 65 years remains R23 800 per annum.

- The exemption for individuals 65 years and older remains R34 500 per annum.

MEDICAL TAX CREDITS

Monthly tax credits for medical scheme contributions will increase as follows:

- From R270 to R286 per month for the person who pays the contributions and the first dependant on the medical scheme

- From R181 to R192 per month for each additional dependant

INTEREST WITHHOLDING TAX (IWT) AND DIVIDEND WITHHOLDING TAX (DWT)

- The default IWT rate remains 15% on interest from a South African source payable to non-residents. Interest is exempt if payable by any sphere of the South African government, a bank, or if the debt is listed on a recognised exchange.

- The default DWT rate remains 15% on dividends paid by resident companies and by non-resident companies in respect of shares listed on the JSE.

RETIREMENT LUMP SUM TAXATION

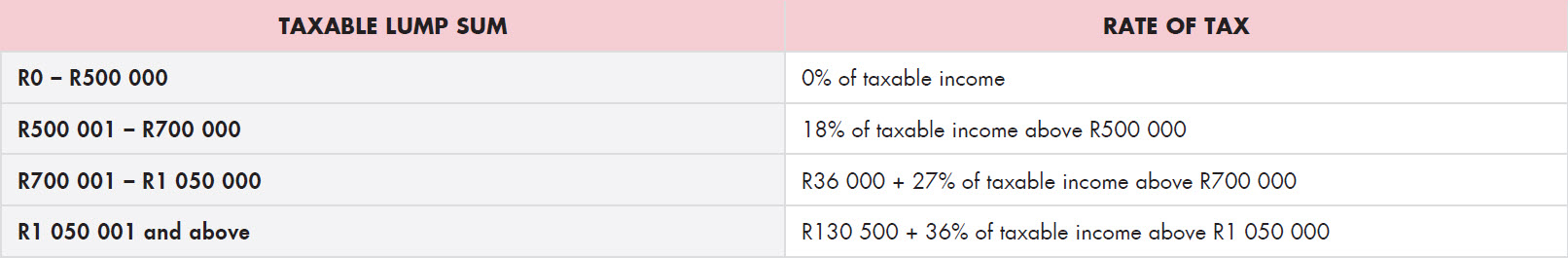

At retirement

The retirement lump sum tax table remains unchanged. The table below illustrates how lump sums will be taxed:

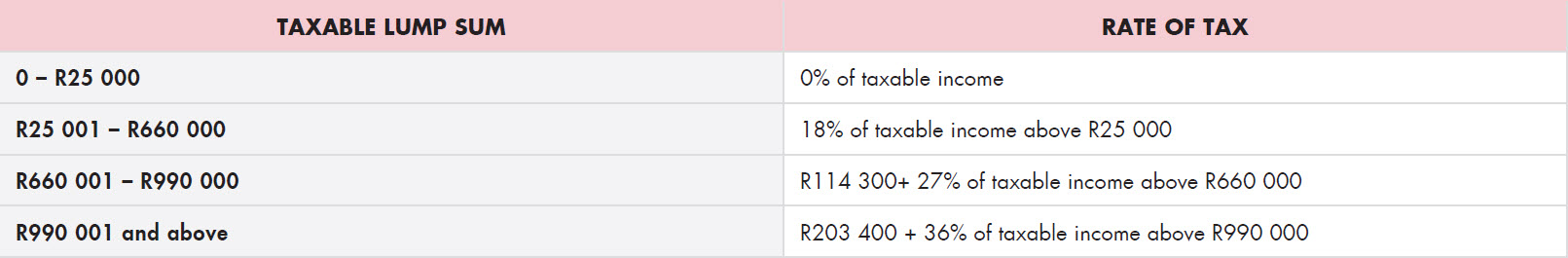

Pre-retirement

The pre-retirement lump sum withdrawal tax table remains unchanged. The table below illustrates how lump sum withdrawals will be taxed:

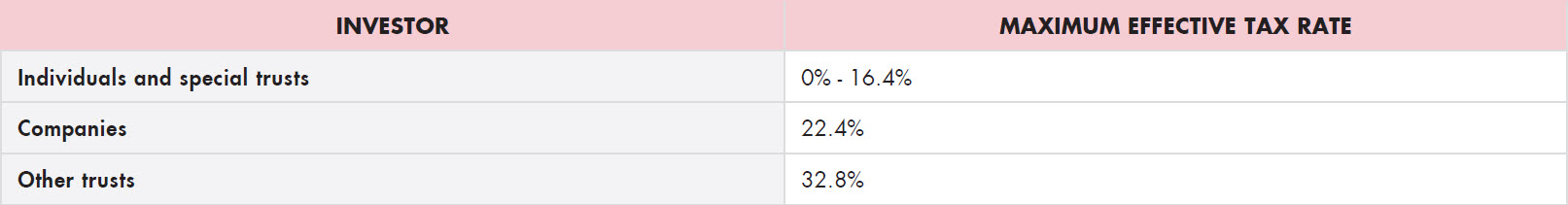

CAPITAL GAINS TAX

The capital gains tax inclusion rate for individuals and special trusts has been increased from 33.3% to 40%, and for other taxpayers from 66.6% to 80%.

The annual exclusion for a capital gain or loss granted to individuals and special trusts has been increased from R30 000 to R40 000.

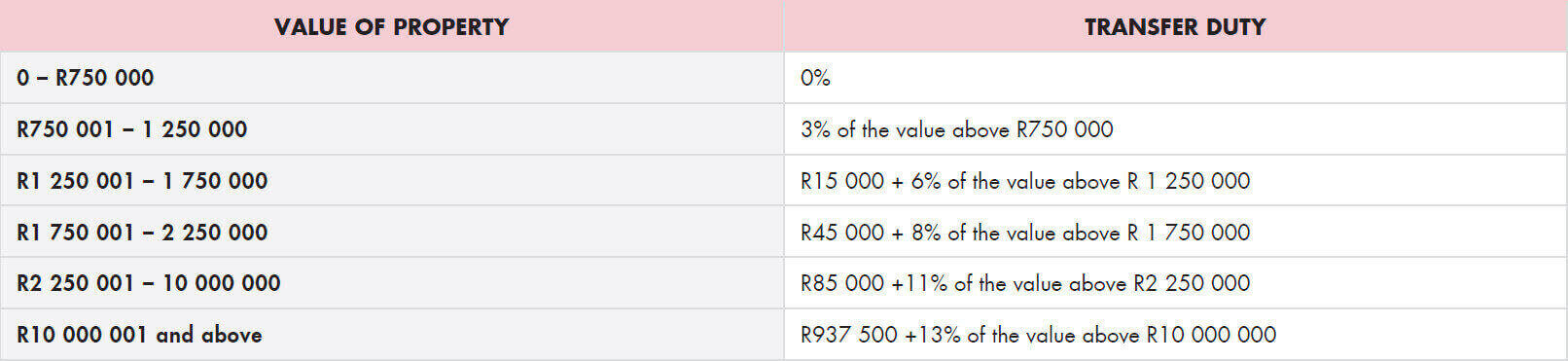

TRANSFER DUTY RATE

The transfer duty rate on properties has been increased from 11% to 13% for properties above R10 million.

RETIREMENT REFORM

Annuitisation of provident fund benefits to be postponed to 1 March 2018

The Revenue Laws Amendment Bill 2016 has been enacted to amend the Income Tax Act to delay annuitising provident funds at retirement until 1 March 2018.

Changed tax deductions on contributions to retirement funds to be implemented on 1 March 2016 as scheduled

Members of all retirement funds will now be able to deduct their contributions (and contributions made on their behalf by their employers) up to a maximum of 27.5% of the higher of taxable income or remuneration, subject to an annual ceiling of R350 000. Contributions made by employers on behalf of employees will still be treated as a taxable fringe benefit in the members’ hands.

CHANGES PROPOSED FOR THE FUTURE

Transfers of tax-free savings accounts between service providers

The implementation date to allow transfers of tax-free investments between service providers will be postponed from 1 March 2016 to 1 November 2016 to provide service providers additional time to finalise the required administrative processes. Draft regulations outlining the transfer process will be published in the near future.

Including passive income in taxable income for the purpose of retirement contribution deductions

The current wording of section 11(k) of the Income Tax Act, which introduces the harmonised tax regime for retirement contributions, does not allow for contributions to any retirement fund to be offset against passive income. It is proposed that section 11(k) be amended to allow for retirement contributions to be deducted against passive income, subject to the available limits. The intention is for members to be able to include passive income, such as living annuity income and interest income, in the taxable income figure used to determine the maximum allowable deduction for their retirement fund contributions from 1 March 2016.

Revising foreign pension contributions, annuities and pay outs

When the residence-based taxation system was introduced in 2001, section 10(1)(gC) was added to the Income Tax Act to exempt foreign pensions derived from past employment in a foreign jurisdiction (i.e. from a source outside of South Africa). Questions regarding the treatment of contributions to foreign pension funds, and the taxation of payments from foreign funds, raise a number of issues. A review is required to determine the appropriate treatment, taking into account the tax policy for South African retirement funds.

Changes to the tax treatment of transfers to trusts

To limit taxpayers’ ability to transfer wealth to trusts without paying estate duty or donations tax, it is proposed that any assets transferred to a trust through a loan should be included in the estate of the founder at death, and that interest-free loans to trusts be categorised as donations. Further measures to limit the use of discretionary trusts for income-splitting and other tax benefits will also be considered.