Five years on from the start of the Global Financial Crisis, as economic uncertainty continues across the world, investors remain sceptical about exposing their savings to these risks. Seema Dala asks: does it still make sense to add offshore investments to your portfolio?

The ALSI: a very small piece of the pie

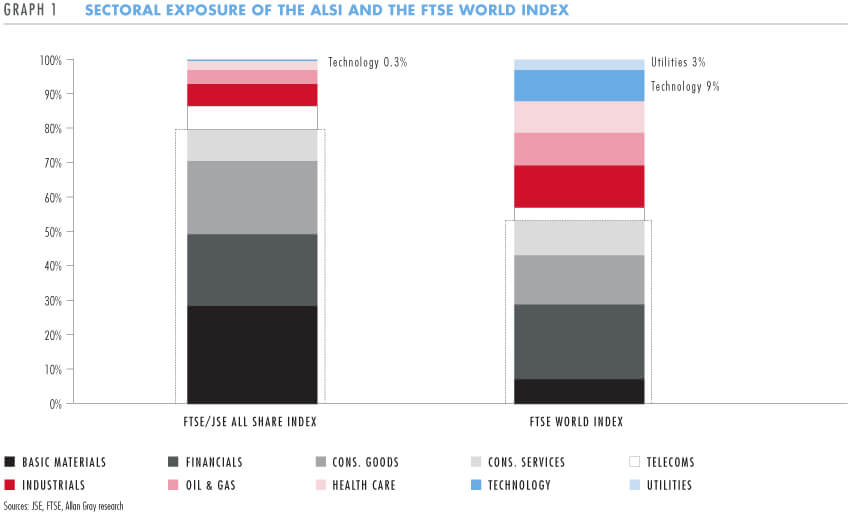

Offshore investing is an ever-popular watercooler discussion topic - is it a good idea, how to do it, and how to know when the time is right? South Africans still have well below the regulated 25% of their retirement funds invested in foreign assets. The vast majority of us invest in equities listed on the Johannesburg Stock Exchange (JSE). While the FTSE/JSE All Share Index (ALSI) is well-developed and houses some large globally diversified businesses, it makes up just over 1% of the world's total listed equity universe by market capitalisation. It is also a concentrated index: approximately 40% of the total market capitalisation on the ALSI consists of just five shares - BHP Billiton, SAB, Anglo American, Richemont and MTN. Looking at the picture from a sectoral perspective, as we have in Graph 1, 80% of the ALSI is made up of shares in the Basic Materials, Financials, Consumer Goods and Consumer Services sectors; these four sectors make up just half of the FTSE World Index (WI). This implies that relative to the WI, investors on the ALSI are overexposed to these sectors, and conversely, have too little exposure to sectors like Technology and Utilities, which together make up 12% in the WI but just 0.3% in the ALSI.

DIVERSIFICATION IS ONLY USEFUL WHEN THE ASSETS BEING ADDED TO THE PORTFOLIO HAVE LOW CORRELATIONS WITH THE EXISTING ASSETS

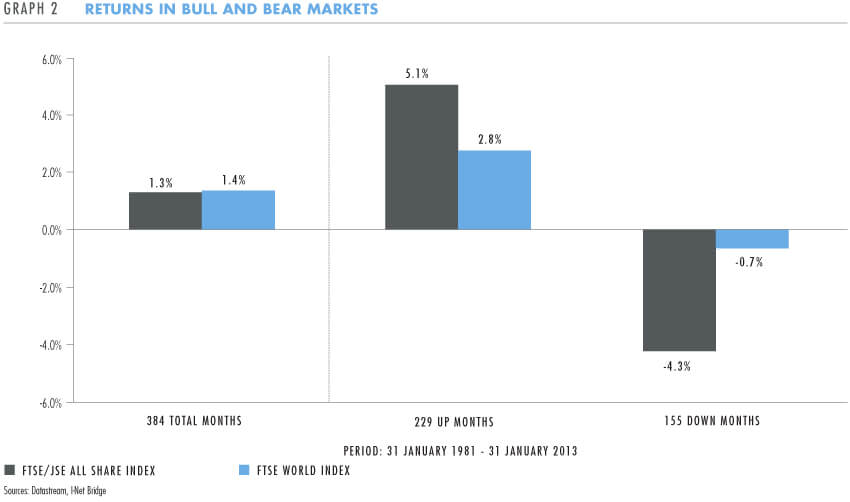

Intuitively it makes sense to increase exposure to the sectors and markets that are underrepresented in our local market. Adding international equity exposure diversifies your returns. One way to illustrate this is by examining the returns of both the ALSI and WI during periods when the ALSI experienced positive returns ('up' months) and periods where the ALSI experienced negative returns ('down' months). Graph 2 shows ALSI and WI monthly returns in rands over the last 32 years. During the 384 months from 31 January 1981 to 31 January 2013, the ALSI returned 1.3% per month in rands compared to the WI, which returned 1.4%. During the 229 ALSI up months, the WI also experienced positive returns, but to a lesser extent than the ALSI, returning 2.8% per month on average compared to the ALSI's 5.1%. However, in the 155 months that the ALSI experienced negative returns, where the value of the index fell on average by 4.3% per month, the WI lost just 0.7% per month.

Lessons in portfolio theory

Correlation measures the strength of the relationship between the returns of different asset classes:

- A positive correlation between two asset classes means that returns tend to move together

- A negative correlation implies that returns move in opposite directions

- A correlation of zero means there is no relationship between the returns of the shares of the two different asset classes

Diversification is only useful when the assets being added to the portfolio have low correlations with the existing assets. As we add asset classes to a portfolio which have negative or zero correlations to the assets which are already in the portfolio, the portfolio becomes more diversified. This should in turn reduce the volatility, or unpredictability, of portfolio returns.

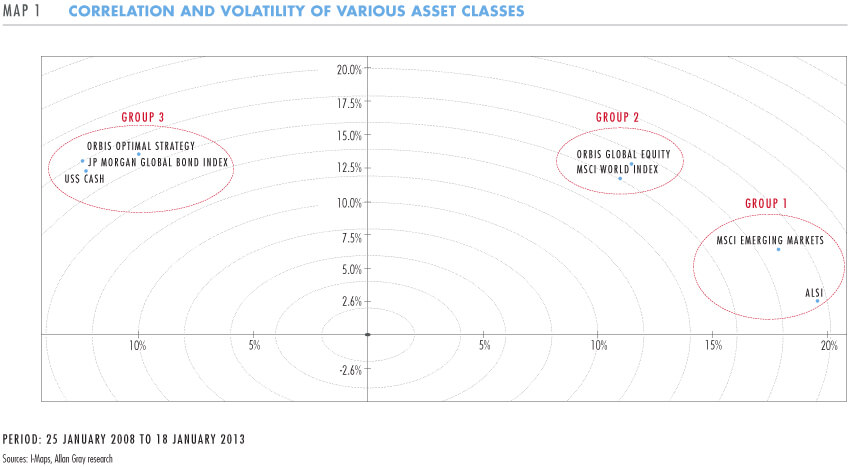

Map 1 uses the I-Maps Visual Positioning System to create a correlation and volatility map, which is a simple visual tool that shows the correlations between various asset classes and displays the risk-reduction benefits of adding various asset classes to a local portfolio. Assets that appear at 180 degrees to each other are negatively correlated, whereas those that are at 90 degree angles are uncorrelated. The ALSI appears far away from the centre point, which means that the returns on this index are relatively volatile. The position of the MSCI Emerging Markets Index shows that the returns on these markets are similarly volatile, and importantly that there is a strong positive correlation to the ALSI, implying that there would be little diversification benefit from adding emerging market exposure to an ALSI portfolio. We have labelled these assets as 'Group 1'. Group 2 reflects the returns of global equities, including the MSCI World Index and the Orbis Global Equity Fund. Interestingly, since 2009 the returns on global markets have become more correlated to emerging markets and the ALSI, a result of increased correlations across major markets globally (as discussed in Quarterly Commentary 1, 2012). However, these developed market assets remain relatively less correlated to the ALSI, implying that the overall risk level of the ALSI portfolio will be reduced by the addition of these assets. On the far left, Group 3 is comprised of other foreign assets, including global bonds and cash. The Orbis Optimal Strategy, which is a hedged equity portfolio, is also in this group. These asset classes are highly uncorrelated to the ALSI, so adding these assets to a portfolio of local assets would significantly reduce overall portfolio volatility.

INVESTING OFFSHORE WILL ALLOW YOU TO GAIN EXPOSURE TO SECTORS THAT ARE UNDERREPRESENTED IN SOUTH AFRICA

Offshore exposure in Allan Gray's portfolios

Investors in those Allan Gray portfolios which are mandated to include an offshore component, gain offshore exposure via our global investment partner, Orbis. As Map 1 shows, the Orbis Global Equity Fund, like the MSCI World Index, is less correlated with the ALSI than other emerging market funds, suggesting that it would provide a diversification benefit to local investors. Unlike investing in an index, where the shares with the largest market capitalisations would be dominant, the shares in the Orbis Global Equity Fund are carefully selected by a team of experienced global analysts who apply the same bottom-up, fundamental research approach favoured by Allan Gray. This means that the best investment opportunities across sectors and markets are carefully researched, and the ideas with the largest return potential, i.e. that are trading at significant discounts to Orbis’ assessment of their intrinsic values, are included in the Fund. Investors into the Orbis Global Equity Fund would currently have over 20% exposure to the Technology, across North America, Asia ex-Japan countries and Europe.

As the positioning of the assets in Groups 2 and 3 shows, the last five years have been characterised by high correlations between the returns investors have achieved in the Orbis Global Equity Fund and the Orbis Optimal Strategy, and the underlying asset classes in which these Funds are invested. These market conditions are challenging for stock pickers like Orbis. Over the long term, however, markets tend to mean-revert, and we anticipate that going forward the returns will be relatively less correlated. It is extremely difficult to predict macroeconomic events with any certainty, and even more difficult to predict the impact these will have on stock market returns. We can be certain that investing offshore will allow you to gain exposure to sectors that are underrepresented in South Africa, and also reduce the overall riskiness of your portfolio. However, diversification alone cannot guarantee above-benchmark returns at lower levels of risk: finding and investing in shares that are undervalued by the market is the most important determinant of future returns in a portfolio.