We are pleased to introduce the Orbis SICAV Global Cautious Fund (Global Cautious or the Fund), a low equity, global multi-asset fund that we believe fulfils the needs of investors looking for a cautious balance between investment returns and risk of loss. We think it is a useful addition to the more conservative investor’s toolkit and the Orbis range of funds.

Like Allan Gray, Orbis offers a focused range of funds. New funds are only introduced to this range after careful consideration, and where we believe the addition would better enable our clients to meet their underlying objectives.

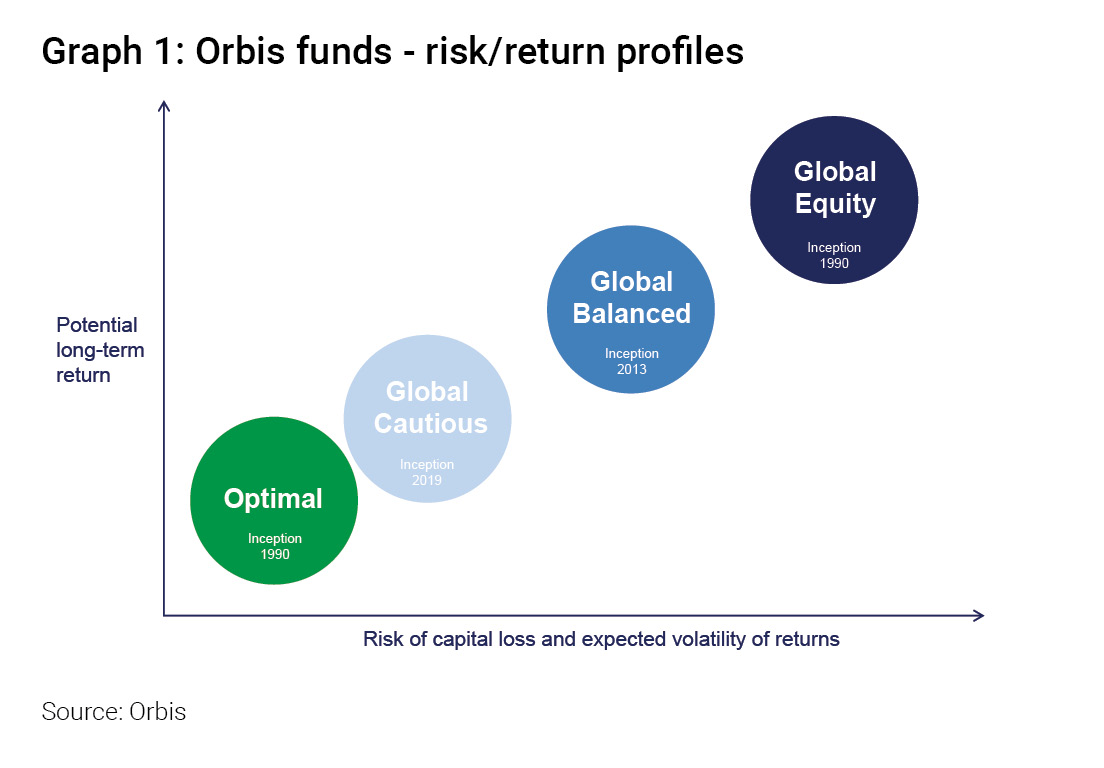

Orbis launched its first global multi-asset class fund, the Orbis SICAV Global Balanced Fund (Global Balanced), in 2013. Global Balanced aims to balance capital appreciation, income generation and risk by investing directly in a diversified global portfolio of equities, fixed income and commodity-linked securities. Global Cautious has the same tools as Global Balanced, but the key difference is that its exposure to riskier assets will be materially lower through the cycle, and therefore suitable for more risk-averse investors. Simplistically, Global Cautious can be seen as the more risk-averse “younger sibling” of Global Balanced.

How does Global Cautious fit in with the other Orbis funds?

For many years, Orbis has served clients with a small range of funds split between long-only equity funds, a high equity allocation multi-asset fund, and lower risk absolute return funds (the Orbis Optimal SA funds) which substantially hedge stock market exposure. In South Africa, there has been an increased demand for multi-asset funds that deliver US dollar returns with lower equity exposure and reduced volatility. We believe that Global Cautious fulfils this need.

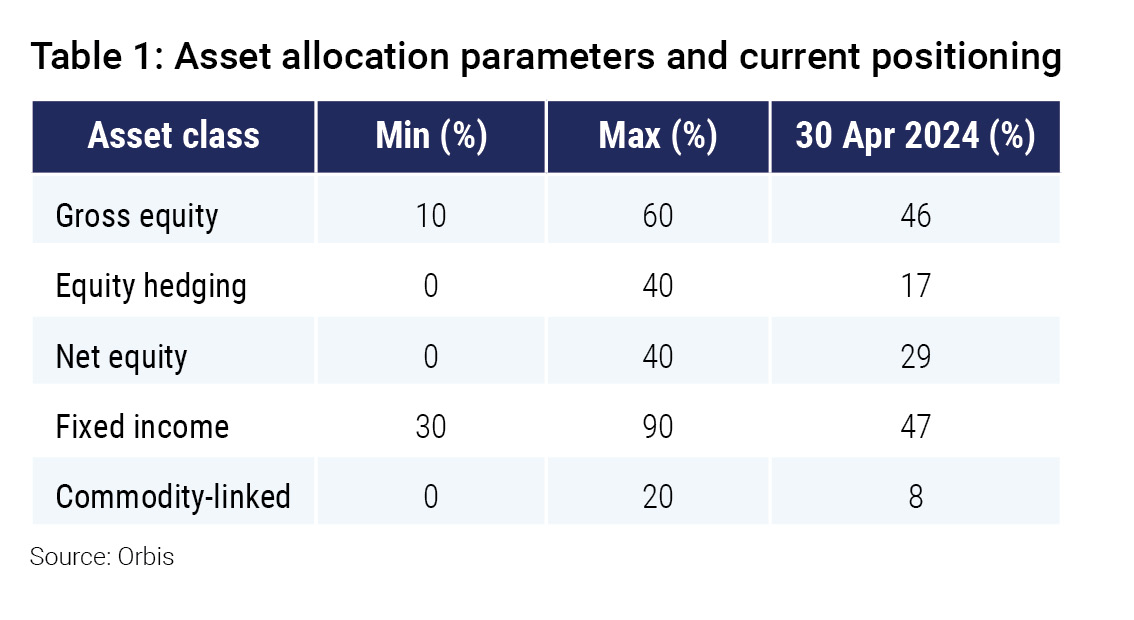

Global Cautious was initially launched five years ago in the UK and draws on the same philosophy, process, tools and research from Orbis’ investment, currency and quantitative analysts worldwide. The Fund has been designed to allow for flexibility in its asset class exposure parameters. This helps ensure that Orbis delivers on its mandate over the very long term and in all kinds of market environments. As shown in Table 1, the Fund can have variable exposure to equities, ample exposure to fixed income and has the ability to invest in commodity-linked instruments. The Fund can also adjust its equity and currency exposures using hedging.

Like all Orbis funds, the positioning of Global Cautious – including the percentage of the portfolio that is allocated across the various asset classes – is driven chiefly by Orbis’ bottom-up security selections, drawing on Orbis’ fundamental research process and capital allocation capabilities. Building the portfolio from the bottom up forces equity, fixed income and commodity-related ideas to compete for client capital. The resulting competition for capital between individual securities across asset classes drives the shape of the portfolio, including its asset class exposures. A stable stock with steady fundamentals may compete against a high-yield bond, which may compete with a riskier stock coupled with stock market hedging. This is managed to achieve the appropriate balance of risk and reward, given the Fund’s objective, which is to cautiously balance appreciation of capital, income generation and risk of loss with a diversified global portfolio.

By combining this bottom-up process with Orbis’ asset allocation views, the risk, volatility and return profile of Global Cautious sits between that of Global Balanced and the Orbis Optimal SA funds, as shown in Graph 1.

The experience of Global Cautious so far

Since its inception in 2019, Global Cautious has navigated a volatile global market environment and delivered an annualised US dollar return of 3.4%. This compares favourably to the average of peers returning 2.5% and a low equity composite benchmark (30% global equities/70% global bonds) which delivered 2.3%, although it is lower than the Fund’s performance fee benchmark (US$ bank deposits plus 2%) return of 4.4%. Reviewing the performance since inception provides some useful colour as returns were not achieved in a straight line.

The first three years of the Fund’s existence represented a different environment to what unfolded since 2022, which is discussed below. At inception in 2019, interest rates in the developed world were timidly starting to creep away from zero, but global bond yields remained low and unattractive, in our view. COVID-19 arrived in 2020 and, as markets crashed, central banks printed trillions of dollars to buy bonds in the hopes of stabilising markets and stimulating economic activity. This pushed up bond prices, driving bond yields down to record lows. In stock markets, physical businesses plunged, while digital businesses soared. 2021 was more challenging, as speculative behaviour drove markets to new highs, before the worries of higher inflation in the latter half began to spook markets.

The Fund’s positioning in that environment aimed to avoid areas which Orbis believed were overvalued and could potentially fail to meet the objectives of the Fund. As such, Global Cautious has had limited exposure to developed market government bonds. Instead, Orbis has favoured investments in cash, hedged equity, gold-related securities, US Treasury Inflation Protected Securities (TIPS) and selected corporate bonds which Orbis continues to believe would better protect clients’ capital. The underlying share selection is also materially different to the broader market indices as discussed in the current positioning below.

In 2022, Orbis’ positioning proved favourable as both stock and bond markets crashed simultaneously. Global Cautious’ differentiated share selection outperformed, and as both long-term bonds and broad equity markets fell, this was an ideal setup for the hedged equity exposure, which generated positive returns. That tentative return to a more rational, valuation-driven environment took an unwelcome pause in 2023, but Global Cautious has continued to deliver pleasing returns in this environment due to the underlying stock selection.

Please refer to the Q4 2023 Fund commentary for further detail on fund performance for the five years to end December 2023.

Current positioning

The Fund’s positioning has not changed materially since 2023. Orbis continues to prefer TIPS, short-term bonds, selected corporate bonds and cash to traditional long-term bonds. In equities, Orbis favours Japan, the UK and Europe over the US, with the best ideas being in energy, semiconductor manufacturers, energy transition businesses, financials and defence contractors, with minimal exposure to the US tech juggernauts that have dominated markets.

As a valuation-focused stockpicker, Orbis is excited about the opportunities as there are many areas of the market which remain unpopular today. This is an ideal setup for Orbis’ investment approach and philosophy. Like Allan Gray, Orbis does not spend unnecessary time trying to divine the exact path the future will take but instead focuses on building a portfolio that can do well under a range of possible future outcomes.

In Orbis’ view, the current portfolio holds assets that can thrive in an inflationary economic boom, bask in the glow of a goldilocks environment of growth without inflation, or hold their value in a disinflationary recession, as well as assets that can protect against a stagflationary environment. While it is unclear what markets will do over the next 10, 20 or 50 years, Orbis continues to focus on finding securities which trade at a discount to intrinsic value, and from there building a portfolio which cautiously balances capital appreciation, risk of loss and income generation.

For more information about Global Cautious, please refer to the factsheet.