Looking back

We launched the Allan Gray Bond Fund 10 years ago, this month. Ten years passes quickly. The most surprising thing about the period has been the lack of volatility, which has been kept in check by the relatively stable inflation rate, a global bond bull market and local equity bull market.

The yield on the 10-year South African government bond has ranged between 6.2% and 10.5% and spent 90% of the time between 7% and 9.5%. This is a very narrow range compared to the prior 10 years, when yields ranged from 9.5% to 20%. Between today and October 2024 we expect to see substantially more volatility in the South African bond market.

Looking forward

There is little doubt that the real return outlook for developed market bonds is worse than it was a decade ago, and there must be questions about the ability of central bankers to keep rates pinned below 3%. A return to normal yields in developed markets is unlikely to favour South African yields, but the timing of any rate increase is uncertain and could be five years away.

More pressing are local issues, which loom large. The government has benefited handsomely from the commodity super cycle, which boosted revenues and papered over the underlying structural problems in the South African economy. Falling commodity prices and the concomitant effects on GDP growth, and the balance of payments, have brought these issues to light. The government has to deal with the 4% fiscal deficit in order to slow the growth in government debt to GDP, which is approaching 45%. This will be politically difficult and something the ANC government is unlikely to face head-on. Interestingly, the government was running a surplus just seven years ago and bond investors fretted about the shortage of government stock.

The current account deficit, at 6% of GDP, is another issue that needs resolution. This too will require political action that the government does not relish and is unlikely to take. Over the long term, the resolution requires improving productivity that will come through education and labour market reform. The easier, short-term solution will likely come through a weaker rand and higher inflation.

What does this mean for the Allan Gray Bond Fund?

Our long-term view and focus on absolute, rather than relative, returns are the underlying principles which determine how we manage the Bond Fund. We are generally sceptical about economic forecasts, but think it is possible to outperform the bond market by taking a long-term view of the risk/reward balance and positioning the Fund accordingly. We do this by forming a view on the fair value of various bonds. Numerous factors drive our fair value estimates, with the two most important being our long-term inflation forecast and our estimate of the real return investors will demand from South African bond investments. The assets in the Fund are then optimised to give investors the highest returns based on these assumptions.

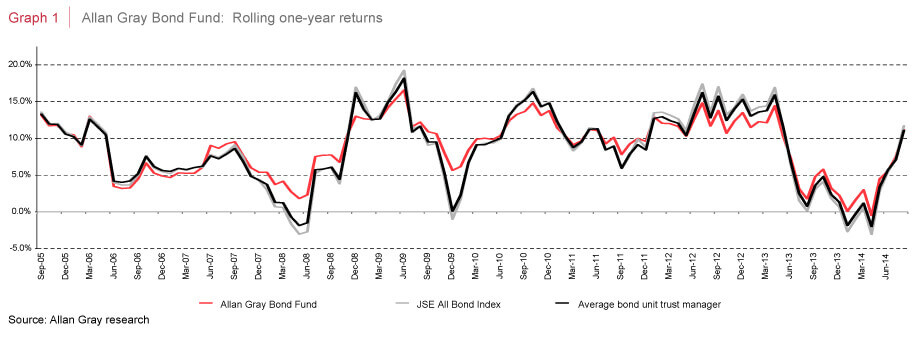

This approach has proven relatively successful. Importantly, the Fund has only once had a negative total return over a 12-month period, as shown in Graph 1. Achieving this over the next 10 years will probably not be possible, but we will strive to reduce risk and generate solid absolute returns for our investors.

Allan Gray Proprietary Limited is an authorised financial services provider. Collective Investment Schemes in Securities (unit trusts) are generally medium- to long-term investments. The value of participatory interests may go down as well as up and past performance is not necessarily a guide to the future. Unit trusts are traded at ruling prices and can engage in borrowing and scrip lending. A schedule of fees and charges and maximum commissions is available on request from Allan Gray Proprietary Limited. Commission and incentives may be paid and if so, would be included in the overall costs. Fluctuations and movements in exchange rates may also cause the value of underlying international investments to go up or down. Forward pricing is used on a daily basis. Allan Gray Unit Trust Management (RF) Proprietary Limited is a member of the Association for Savings & Investment SA (ASISA).