Warren Buffet famously said that there are two rules when investing, 'Rule No.1: Never lose money, Rule No.2: Never forget rule No.1.' Shaun Duddy discusses why capital protection is so important for the creation of wealth over the long term, and the role that our investment philosophy plays in maximising capital protection.

The impact of a capital loss

We have discussed the benefits of compounding returns on numerous occasions. The basic principle is that the returns earned over a given period are earned on the total value of the investment at the start of that period, not only on the original capital contribution. This means that as an investment grows there is a larger base on which to earn subsequent returns.

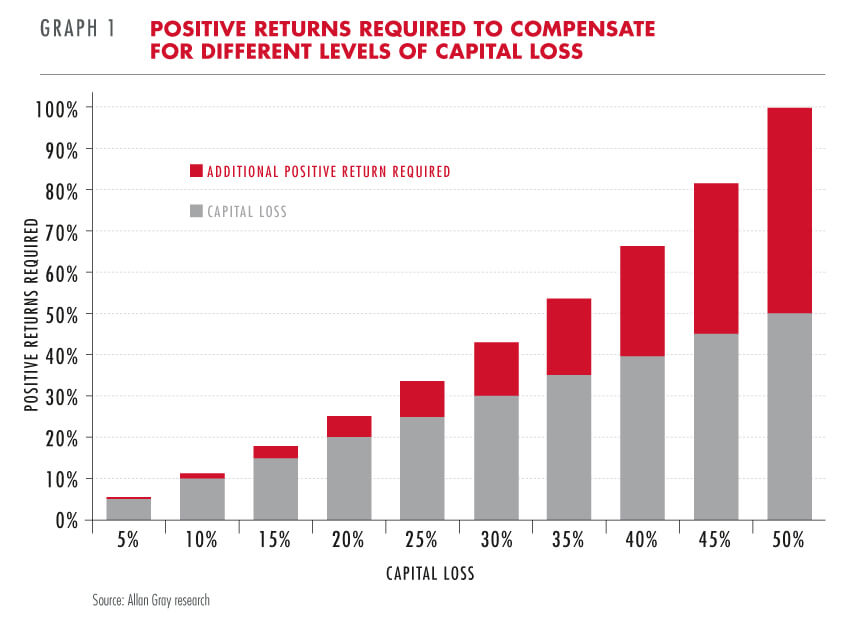

However, the reverse is also true. If an investment experiences negative returns (i.e. capital losses), the base on which future returns are earned is smaller. This means that the positive percentage return required to make up the loss will always have to be greater than the negative percentage return that caused the loss. Graph 1 shows that although the extra return required is small for small losses, it increases exponentially and quickly becomes a significant number.

The risk of capital loss differs considerably between unit trusts. It is important that you are comfortable with the risk your unit trust will take in pursuit of return. Equity unit trusts, for example, are mandated to invest 100% in equities, which tend to be more volatile than other asset classes, resulting in a greater risk of capital loss over the short term. Asset allocation unit trusts, on the other hand, have more limited equity exposure and allow fund managers to invest in other asset classes, providing a greater number of investment options to select from when managing the risk versus return trade-off. However, even within equity-only mandates, managers can take on different levels of risk, depending on the shares they choose to invest in. Even in our equity-only mandates, we try our best to limit the risk of capital loss as we believe this gives our clients the best chance of growing wealth over the long term.

The benefits of capital protection

From its peak in May 2008 to its low in November 2008 the FTSE/JSE All Share Index (ALSI) lost more than 45%. Graph 1 shows us that the positive return required to make up that loss would have been approximately 83%. Over the same period, the Allan Gray Equity Fund lost approximately 31%. Although only 14 percentage points less than the ALSI's loss, the positive return required to make up that loss was just 45%, fully 38 percentage points less than that required by the ALSI.

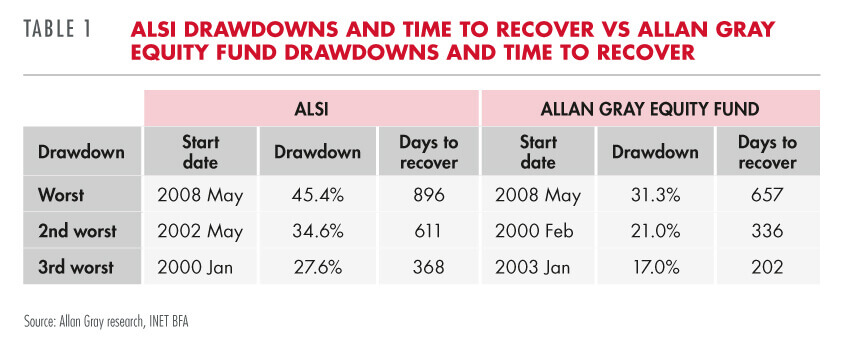

Smaller losses are easier to make up and, by extension, tend to be made up more quickly than larger losses, increasing the time available to earn returns on a higher base, which ultimately leads to greater growth of your wealth. This is illustrated in Table 1, which compares the three largest drawdowns for the ALSI and the Equity Fund since the Equity Fund's inception in October 1998.

Following this logic, if investment managers could maintain 100% of investors' capital during 'down' periods, and participate fully in 'up' periods, they would produce significant outperformance and wealth for their investors. Unfortunately, this is near impossible to achieve for at least two reasons:

- Few shares can completely escape the drag of a significant market decline, preventing full capital protection during these periods.

- To avoid market declines, a manager has to invest differently from the index, often preventing full participation during positive periods.

Therefore, the best that managers can do is to limit their participation in the market's negative performance. But is limiting the downside really worth sacrificing some upside?

Over periods that include a significant market decline, the benefits of this sacrifice are easier to see. In a bull market, however, the counter argument may be that the dominant trend is upwards, there are few negative periods to protect against, and therefore sacrificing positive returns for capital protection makes little sense. In actual fact, even during bull markets there tend to be a significant number of 'down' periods. For example, during the September 1998 to May 2002 bull market, 40% of the months were 'down' months, between May 2003 and May 2008 it was 30%, and since March 2009 it has been 36%.

Sacrificing some positive return in pursuit of capital protection is therefore a worthwhile investment strategy over the long term. While this may appear to be a conservative approach, it can often result in a better investment outcome than alternative investments that take a lot more risk.

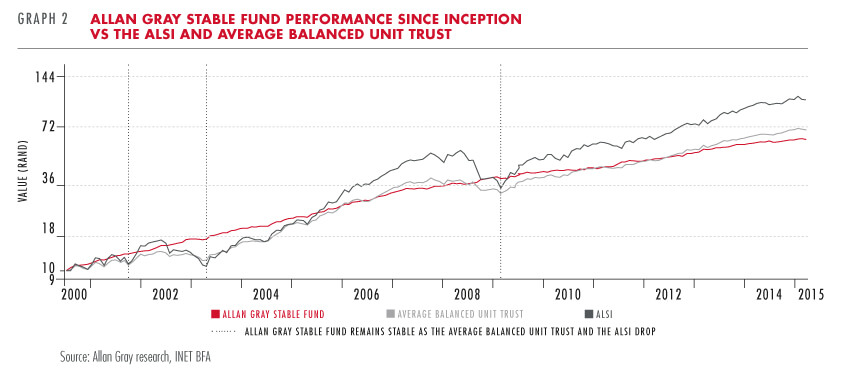

Graph 2 compares the performance of the Allan Gray Stable Fund (maximum 40% equity exposure) to both the ALSI and the average balanced unit trust (maximum 75% equity exposure). Since the Stable Fund's inception, there have been three periods where the market has gone down. During all three, the Stable Fund has done what it says on the tin: taken on less risk and remained stable. This has resulted in the Stable Fund being ahead at all three points, with both the market and the average balanced unit trust often taking years to catch back up. This is deliberately a somewhat unfair comparison: the Stable Fund competes with much lower return peers than those included in the average balanced unit trust.

Our investment philosophy: capital protection built in

We use a 'bottom-up' approach when selecting investments, thoroughly analysing and understanding individual shares to identify those that are trading below what we identify as their intrinsic value. We are interested in the opportunity that each individual share presents. This differs to a 'top-down' approach, which uses broad macroeconomic and sector views as a starting point. In our Balanced and Stable Funds, we use the same 'bottom-up' analysis to invest only in those assets that we believe have a reasonable likelihood of outperforming cash.

WE ARE ALWAYS WILLING TO SACRIFICE SOME UPSIDE TO PROTECT YOUR INVESTMENT WHEN THE MARKET INEVITABLY MOVES DOWN

By investing in undervalued assets, we aim to provide investors with return when the price reverts to its intrinsic value. This provides a level of capital protection. Investing only when the market price is well below intrinsic value (i.e. with a margin of safety) serves to further minimise the probability of capital losses, while increasing the potential level of future returns. In other words, the further the market price has already fallen relative to the true intrinsic value, the less likely it is to fall further and the greater the return that can be achieved before the market value equals the true intrinsic value. However, it is important to note that there will be periods where very few shares offer a margin of safety, even though there may be some shares trading at discounts to intrinsic value.

Capital protection in practice

Over the course of our history, consistently implementing our investment approach has allowed us to translate the theoretical benefits of capital protection into reality.

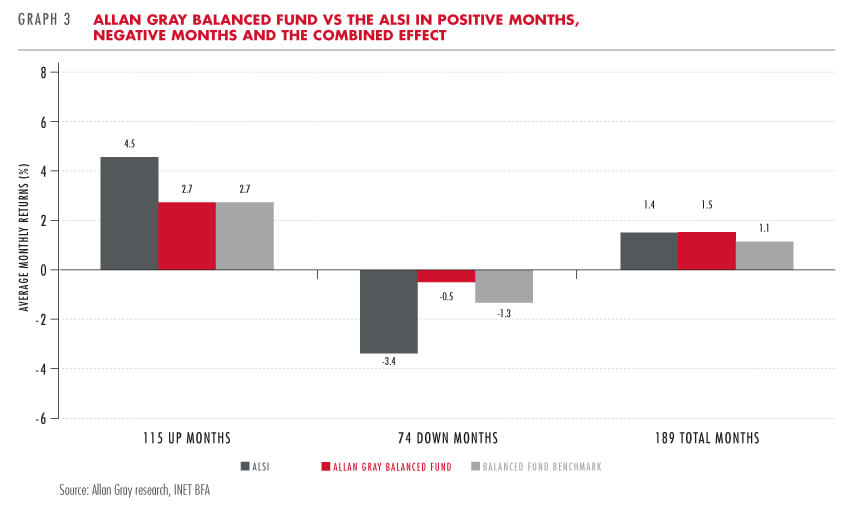

Graph 3 shows that since inception, the Allan Gray Balanced Fund has performed in line with the ALSI overall, but lost much less along the way. This can also be seen from the maximum drawdown and lowest annual return numbers, now shown at the back of this magazine in the performance tables. Our unit trusts typically experience smaller negative returns when the market goes down, helping them to outperform over the long term.

Balancing risk and reward

When deciding how to invest your money, we pay little attention to how our competitors choose to invest, the latest investment trends and even our benchmarks. While many managers define risk as the risk of being different, we believe that our contrarian philosophy and focus on capital protection make a positive difference to your investments.

With markets at current high levels, investors should not be surprised that there are fewer shares that meet our investment criteria. This has resulted in lower net equity weightings in our Balanced and Stable Funds, currently around 56% (versus a 75% maximum) and 17% (versus a 40% maximum) respectively, and a higher proportion of defensive shares (i.e. shares that tend to be less risky than the market) across our unit trusts.

We believe that our positioning has been, and continues to be, appropriate given the current balance between risk and reward. However, it has led to recent under performance relative to our peers, as the market has continued to rise despite being expensive by historical standards, benefiting unit trusts holding a higher percentage in equities. Nevertheless, if our view that markets are expensive is proven correct, and our unit trusts protect your capital through the correction, then the returns that you have given up in the short term will be more than compensated for in the long term.

We are always willing to sacrifice some upside to protect your investment when the market inevitably moves down. We believe our approach gives you the best chance of growing your wealth over the long term.