The landscape of executive remuneration continues to evolve and, as a result, we have refined our remuneration framework by developing a qualitative scorecard to examine remuneration schemes. Using the results of the scorecard, Nicole Hamman draws on examples from our clients’ top 25 holdings to showcase how we evaluated executive remuneration during 2021.

Executive remuneration remains the top governance theme we engaged in during 2021. Engagement with remuneration committees is prompted by the JSE Listings Requirements, which make it mandatory for a company with a primary listing on the JSE to table separate non-binding advisory votes on executive remuneration policies and implementation reports at the company AGM.

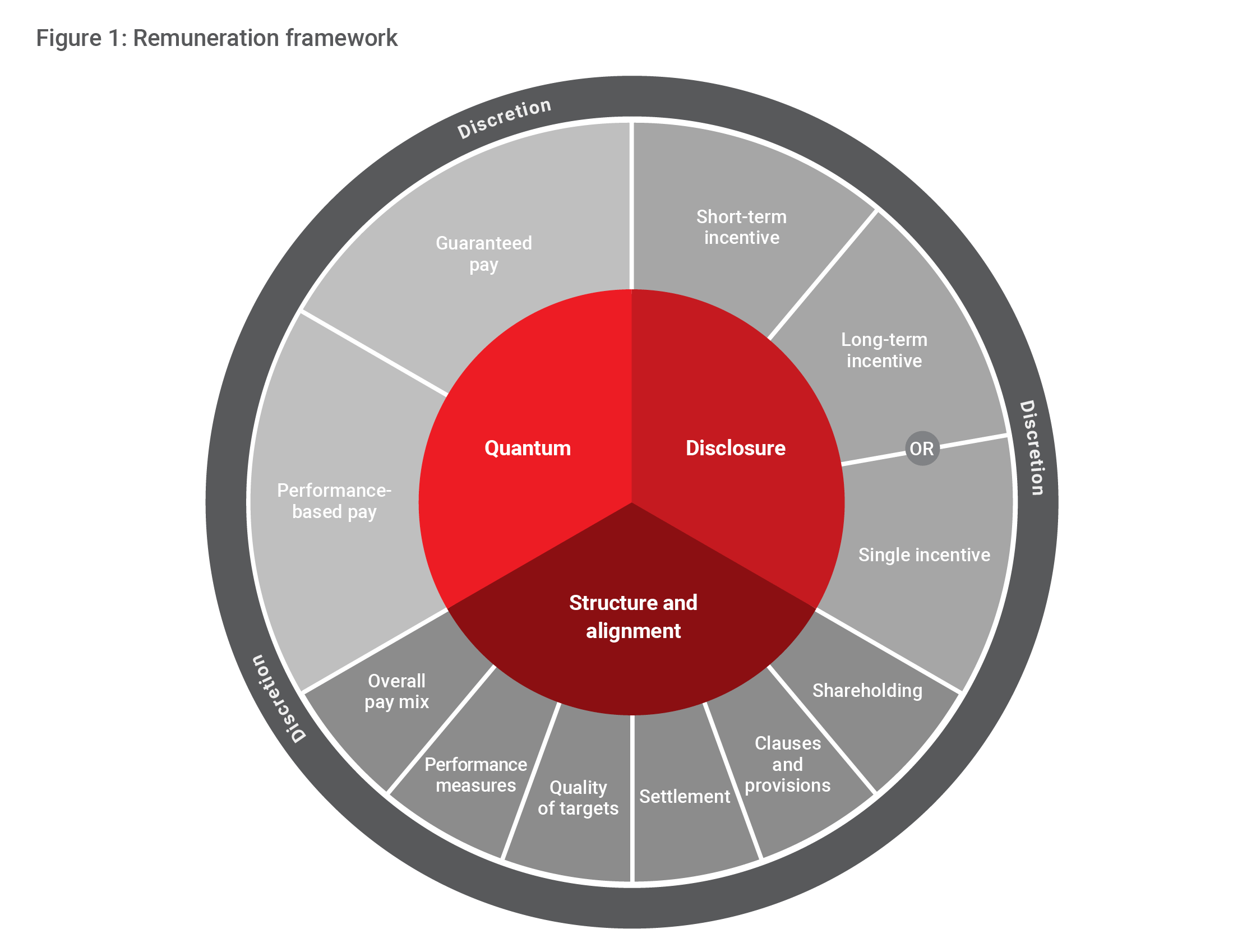

Our qualitative scorecard expands on the key remuneration factors outlined in our “Policy on ownership responsibilities”, which is available via our website. We rate each key remuneration factor (as demonstrated in Figure 1), as well as the overall remuneration scheme, on a scale of Excellent, Good, Average and Poor.

What is an exemplary remuneration scheme?

We are often asked by remuneration committees to provide examples of companies’ remuneration schemes we consider exemplary. We believe the objectives of a remuneration scheme should be to attract, reward and retain competent executives, while incentivising alignment between the long-term interests of executives and shareholders. The manner in which companies structure their remuneration schemes to achieve those objectives can vary, making it difficult to recommend a single company’s scheme that acts as a model to others.

We believe the objectives of a remuneration scheme should be to attract, reward and retain competent executives …

There are numerous companies pursuing improved remuneration schemes. Here, we will touch on shareholding, performance measures, disclosure of short-term incentives (STIs) and the overarching use of discretion by remuneration committees.

Alignment: Shareholding

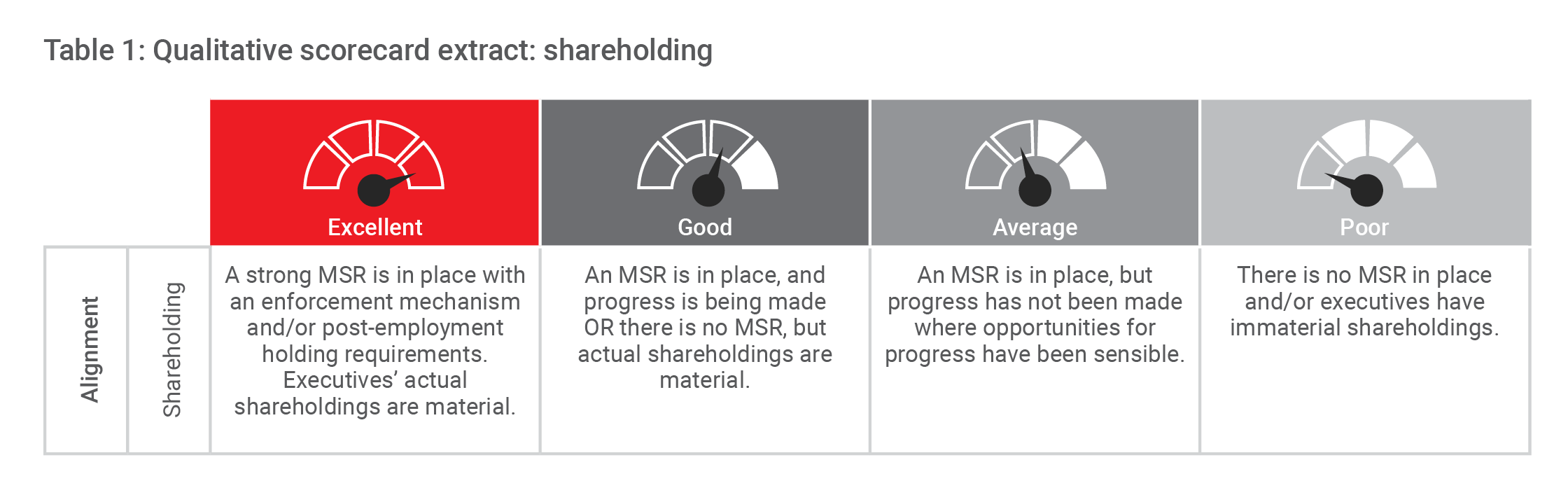

We have a strong preference for executives to own shares in the companies they manage, as there is no better method of aligning executives’ interests with those of shareholders than having executives who think like shareholders. In our assessment, we consider the tenure of executives and look for reasonable progress towards building a material shareholding.

… there is no better method of aligning executives’ interests with those of shareholders than having executives who think like shareholders.

A top 25 holding whose shareholding we rated as Excellent is asset manager Ninety One. There is a minimum shareholding requirement (MSR) in place, which requires the CEO to hold 1 000% of their guaranteed pay. It includes a post-employment holding requirement, whereby they need to retain 500% for two years after ceasing to be an executive.

Thresholds differ per company, and a higher threshold is possible with founder executives. We recommend a threshold of between 300% and 500% of guaranteed pay for the CEO, and lower thresholds for other executives.

Investment holding company Remgro is a top 25 holding whose shareholding we rated as Good, despite there being no MSR in place. Considerations included that the current CEO’s shareholding is material, and that there is a strong history of the CEO maintaining a material shareholding in the company.

We encourage formal shareholding requirements for all companies. Even where current executives’ shareholdings are material, the requirements assist incoming executives. We consider an enforcement mechanism, where executives are restricted from cashing out their long-term incentives (LTIs) until the required level is achieved, as a powerful tool, because it ensures the MSR is effective in building a material shareholding for executives.

Table 1 provides an extract from the qualitative scorecard on shareholding. We monitor executives’ actual shareholdings, and if a formal shareholding requirement is in place, we closely inspect the terms of the requirement.

Alignment: Performance measures

The effectiveness of a remuneration scheme is dependent on selecting the correct performance measures. In our assessment, we consider whether the measures selected are suitable for the given company and create alignment between management’s experience and shareholder outcomes.

Suitability

We encourage companies to select performance measures that fit their long-term strategic objectives. For example, where a company is entering an expansive period, we would encourage the inclusion of capital efficiency measures to ensure executives are incentivised to undertake projects in a value-accretive manner.

Alignment

We recommend performance measures that are aligned with shareholder outcomes. For example, where a suitable peer group is available, we encourage the use of relative measures. The ongoing uncertainty around the outlook for the future has illustrated the importance of having relative measures that minimise the impact of external factors. This makes target-setting significantly easier.

These measures also take industry pressures into consideration and better reward executives for performance under their control. We have found it adds a layer of sensibility to prevent pay outcomes from being misaligned with shareholder outcomes. Misaligned outcomes are a common reason we recommend our clients vote against a company’s implementation report.

A top 25 holding whose long-term performance measures we rated as Good was pulp and paper company Sappi. Its measures include relative total shareholder return versus peers (50%) and cash flow return on net assets (50%). The cash flow measure is not particularly strong – we would prefer a per-share measure of free cash flow – but we view the use of relative total shareholder return as a strong measure.

Disclosure: Short-term incentives

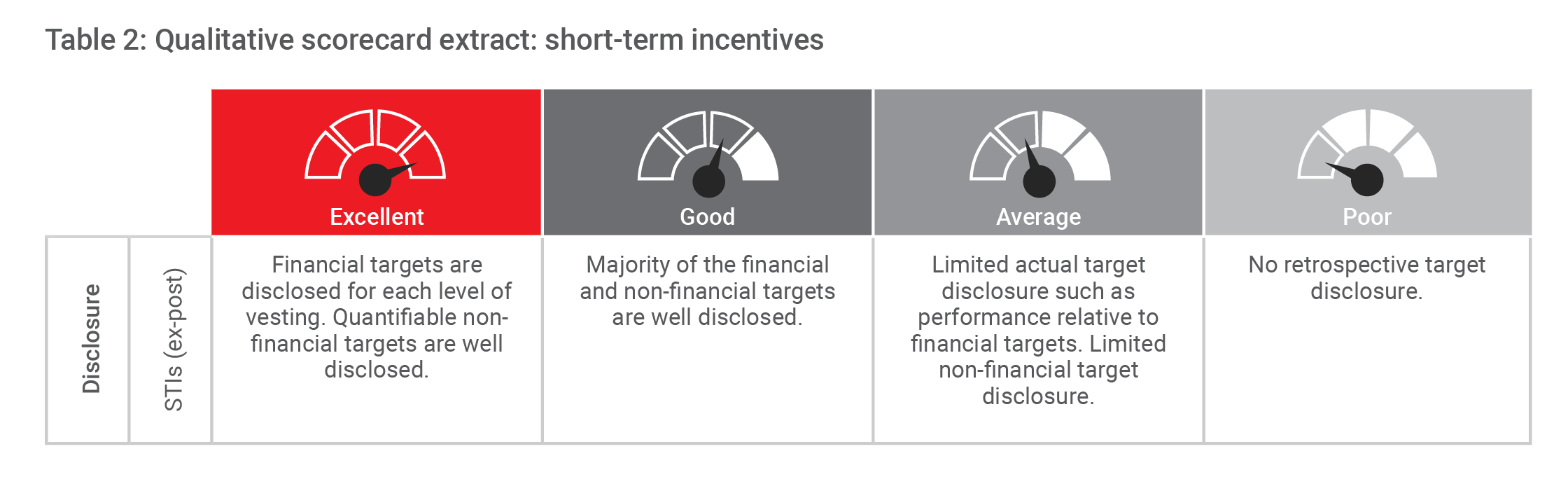

Our objective is to assess whether the quantum of executives’ performance-based pay is sensible relative to company performance. To perform this assessment, we require an adequate level of disclosure. Given the sensitive nature of short-term targets, we encourage detailed retrospective (ex-post) disclosure of STIs.

Financial measures

A top 25 holding whose STIs disclosure we rated as Good is mining and metals group Impala Platinum. Its financial measures disclosure included:

- The weighting of each financial measure

- The targets at each level of vesting (threshold, target and stretch)

- The actual pay outcome achieved for each measure

Disclosing the targets at each level of vesting allows us to assess the full extent of the vesting scale, as well as to contextualise whether the outcome achieved is reasonable and the targets sufficiently stretching.

Non-financial measures

We generally see poor disclosure of the achievement against non-financial measures accompanied by generally high vesting for executives. This disclosure typically includes a qualitative summary of achievements over the period with limited reference to what the targets were at the outset.

We consider this an area where most companies can improve the quality of their disclosure so that it is more meaningful to shareholders. For the more quantitative non-financial measures, we encourage companies to disclose the metrics and targets to justify the vesting outcome.

We understand that the level of disclosure differs per company, and remuneration committees are balancing sufficient disclosure with concerns over market sensitivity. We regularly provide recommendations for improvement during our engagements with remuneration committees and expect the quality of disclosure to improve over time.

Refer to Table 2 for an extract from the qualitative scorecard on the disclosure of STIs.

Use of discretion

This past period has taught us that all discretion is not equal. Remuneration committees are just as accountable for actioning discretion as they are for their inaction in instances where discretion is required. As a result, we are not opposed to the use of discretion, as some circumstances may warrant it to align executive and shareholder outcomes, however, what we do encourage is that remuneration committees exercise discretion pragmatically and only when deemed necessary.

We view discretion as an overarching theme, as it can be exercised with regard to any aspect of our remuneration framework. We consider whether the rationale provided for the use of discretion is reasonable, whether there is symmetry in the application of discretion over time, and its impact on shareholders.

The below examples from companies’ 2021 financial years illustrate the vast scope of discretion as well as some underlying themes.

When in a grey area, transparency is key

Company A, a telecommunications company in our clients’ holdings, had a director who served as an executive director for the first few months of the period before being appointed as a non-executive director. During the period, the company closed one of its LTI schemes and accelerated vesting on its closure. This meant the director’s payment for the period comprised various components, including their salary as an executive, their gains on the vesting of the LTI scheme and their director’s fees. Given that the director ended the period as a non-executive, the various components of their pay were not required to be disclosed.

As this director was the highest-paid board member for the period, we felt it was in the interest of shareholders to disclose the various components of the director’s compensation. We were disappointed by the decision not to disclose this information and communicated our dissatisfaction to the remuneration committee.

After taking all other uses of discretion into account, we rated Company A’s overall use of discretion as Poor.

A lack of discretion can be poor discretion

Company B, a healthcare company in our clients’ holdings, had set its upfront LTI earnings targets (for the three-year performance for the period ending 2023) at the beginning of 2020. This was a period of uncertainty for all companies, and as a result, the earnings target set was very modest.

During our assessment of the 2021 remuneration scheme, we noted the earnings target for the period was already achieved at the end of 2021. This was a result of the target being very modest, as well as working off the low COVID-19-impacted base year of 2020.

We understand remuneration committees are reluctant to amend targets but encourage them to remain committed to ensuring targets are sufficiently stretching for executives. In this case, we would have expected the remuneration committee to revise the target once more information became available to avoid high vesting for non-stretching performance. We highlighted our concerns with the remuneration committee and are hopeful that our suggestions will be considered in the company’s 2022 financial year.

After taking all other uses of discretion into account, we rated Company B’s overall use of discretion as Poor.

The devil is in the detail

A number of companies introduced once-off awards during the 2021 financial year. We strongly advocate regular and consistent granting of share-linked awards as opposed to once-off awards. If remuneration committees had taken the decision to grant once-off awards, we critically examined the conditions under which they had been introduced and how that fitted into the greater context of the remuneration scheme.

We strongly advocate regular and consistent granting of share-linked awards as opposed to once-off awards.

Company C, a property company in our clients’ holdings, introduced a once-off LTI for executives in their remuneration policy, with the award to be made in the 2022 financial year. The award is subject to performance conditions, the majority of which are financial measures. These measures address the company’s long-term strategic objectives that the existing LTI does not cover.

The targets for the three-year performance period were disclosed upfront, and we were able to determine that they were sufficiently stretching. The existing LTI includes a 30% retention element that the company will be removing for the 2022 allocation, given that the once-off award will be allocated during the same period.

After taking all other uses of discretion into account, we rated Company C’s overall use of discretion as Average.

Company D, a financial services company in our clients’ holdings, introduced a once-off discretionary award of shares. There were no performance conditions attached to the discretionary award. The terms included that the shares would vest, to the extent that they exceeded the collective value of the share appreciation rights (SARs) compared to the allocations in 2014, 2015 and 2016. These SARs had vested but were unexercised at the time of the discretionary award. The date at which the vested SARs could be exercised had already been extended.

A consequence of the once-off award was that executives’ downside risk on the SARs that had vested was significantly limited. We did not feel this aligned with shareholders’ exposure to downside risk.

After taking all other uses of discretion into account, we rated Company D’s overall use of discretion as Poor.

Ongoing efforts

The scorecard gives us further insight into how a company’s remuneration scheme compares with those of its peers in our universe and, over time, to its past remuneration schemes with respect to key factors.

For further insight into our executive remuneration considerations, such as those on quantum, see our updated “Policy on ownership responsibilities”. As executive remuneration continues to evolve, we continually adjust our scorecard.

This piece has been extracted from our latest annual Stewardship Report, which gives a full overview of our environmental, social and governance (ESG) efforts.