British American Tobacco provides the rare opportunity to invest in a superior quality business in a stable industry at a discount to the average company. With almost six trillion cigarettes consumed every year, we are confident of the company's ability to sustain and grow profits irrespective of global conditions.

To cease smoking is the easiest thing I ever did. I ought to know because I've done it a thousand times. - Mark Twain

BAT now listed on the JSE

We last wrote about British American Tobacco (BAT) in the Q4 2007 Quarterly Commentary. At the time, BAT was not listed on the JSE and our clients' stake in BAT was held through Remgro and Richemont. In October 2008, Remgro and Richemont separated their core businesses from their holdings in BAT, and distributed their stake in the tobacco company to their shareholders. This resulted in the listing of BAT on the JSE. BAT accounted for 11% of the Allan Gray Equity Fund at the end of June 2010.

BAT has underperformed the JSE All Share Index by 35% since listing. This has only enhanced BAT's relative attraction, since there have been no significant developments that may impair the future cash flows that the business will generate for its owners. On the contrary, the last two years have confirmed the broad stability of the tobacco sector as BAT's earnings continued to grow in line with its historical trend in a harsh economic climate, while many companies have struggled.

Industry structure

The long-term economics of the tobacco industry are attractive for shareholders of the major producers, and, on balance, industry fundamentals have become more favourable over the past decade.

Tobacco products are habit forming and brand loyalty is high, with the typical user changing brands less often than once every 10 years. Consequently, tobacco consumption is steady and predictable.

Furthermore, there has been significant industry consolidation over the last few years. More than 80% of global tobacco is now controlled by five rational competitors.

Barriers to entry are extremely high. Aside from the challenges of establishing and building a brand in markets which restrict or ban advertising, developing a distribution network of sufficient scale to compete with the existing players is near impossible. Suffice to say, no significant new capital has been attracted to the tobacco industry for decades.

BAT'S ABILITY TO GROW PROFITS WITHOUT THE NEED TO RETAIN EARNINGS IS A QUALITY THE MARKET OFTEN OVERLOOKS

Meanwhile, the evolution of excise tax structures from ad valorem (tax as a percentage of price) to specific (flat tax per cigarette) taxes has favoured the entrenched tobacco companies by further raising the barriers to entry and discouraging price competition. Government interests and those of major tobacco companies are essentially aligned.

Company drivers

First world smoking incidence has been in decline since the harmful effects of tobacco usage were discovered in the 1960s. Despite this steady headwind, the factors contributing to shareholder returns have hardly changed over the decades.

Worldwide, almost six trillion cigarettes are consumed every year. Contrary to popular belief, global cigarette consumption is actually growing. Consumption declines in developed markets are more than offset by a rise in consumption of conventional cigarettes in emerging markets. Emerging markets account for over two-thirds of BAT's volumes, and over half of BAT's profits. Over the medium to longer term, BAT's volumes should be flat or may grow moderately.

BAT's revenue growth continues to exceed its volume growth. This is a function of strong pricing power and favourable mix changes. BAT's 'Global Drive Brands' now account for 27% of its sales volumes, double the proportion they accounted for 10 years ago. These brands (Dunhill, Kent, Pall Mall and Lucky Strike) generate higher margins, and are driven by innovation (e.g. re-sealable packs), product refinements (e.g. Dunhill Fine Cut) and selective marketing.

A century of bolt-on acquisitions has resulted in an unwieldy and sub-optimal manufacturing setup. BAT's subsidiaries produce 725bn cigarettes from 50 factories. Management is on track to deliver on its initiative to contain 800m pounds per year in costs by 2012. Back office integration, supply chain initiatives and slimmer management structures, which generate productivity savings, should result in earnings growing faster than revenues.

BAT's reported earnings equate to the free cash generated by the company. Over time, we expect all the free cash to be returned to shareholders, either through dividends or share buybacks.

Challenges

The Australian government is considering passing legislation that would force tobacco companies to remove all colour and logos from cigarette packs from 2012. The adoption of generic, or plain packaging, by governments around the world is probably the single largest regulatory threat to the tobacco industry. Plain packaging will restrict the consumer's ability to differentiate tobacco products, and may result in a loss of market share of premium (more profitable) brands over time. This risk is not new; numerous countries (UK, Canada, New Zealand) have contemplated such action in the past but never decided to proceed. Plain packaging is unlikely to affect overall smoking incidence, and would result in markedly higher levels of illicit trade and lower levels of government tax receipts.

A sharp and unexpected excise or tax increase may also impair industry profitability. Seventy percent of the revenue generated by the sale of every BAT cigarette already goes directly to government in the form of excise and taxes - 10 times more than the profit generated per cigarette for BAT shareholders. Given the low price elasticity of tobacco products, increases in excise generally result in higher cigarette prices, higher overall net manufacturer revenue and higher profits. Recent examples of this were in the US, Brazil, Canada, Pakistan, Ukraine, and South Africa.

Tobacco consumption is not immune to economic conditions. While overall consumption is not significantly affected, illicit trade increases in tough times, particularly when unemployment rises. It is estimated that 12% of world consumption, or 700bn cigarettes annually, are currently sold on the black market.

Many of the regulatory threats tobacco companies face are in the base already. Current volumes are in the context of public smoking bans, advertising and packaging restrictions, health warnings and tax increases. These risks are to some extent also mitigated by BAT's geographical and brand diversity. No single country accounts for more than 13% of profits and BAT's portfolio is evenly distributed between premium, midprice and value brands.

Quality at a discount

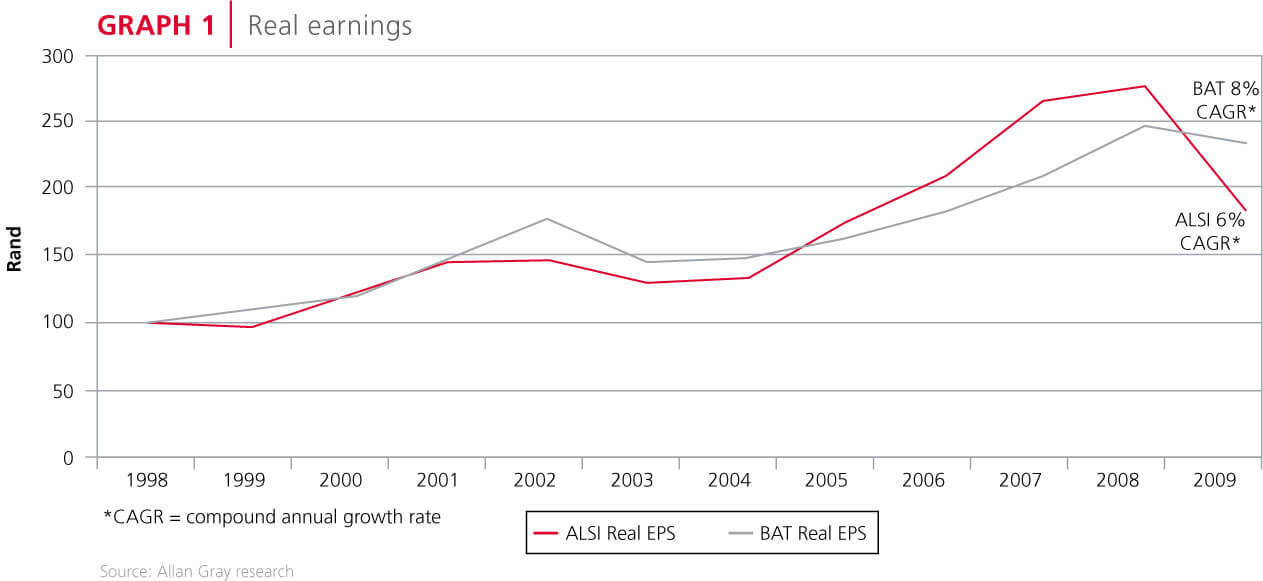

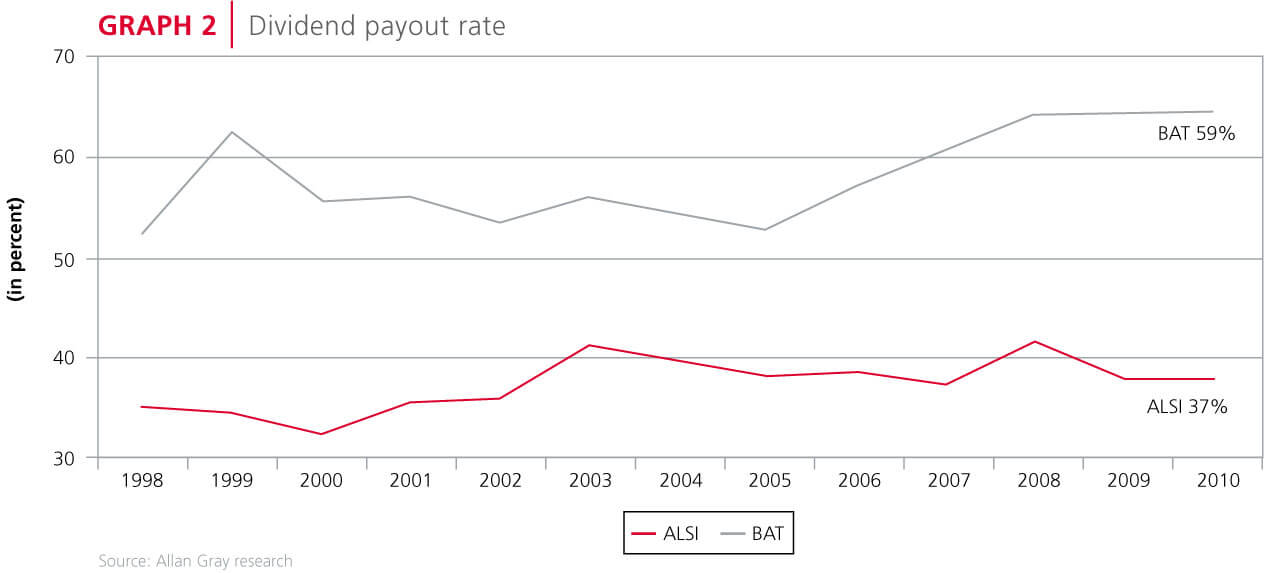

BAT is currently trading on a price to earnings (P/E) ratio of 13x. The FTSE/JSE All Share Index (ALSI), by contrast, is on 16x earnings. The real attraction of BAT, however, is that the company's economics allow it to pay out substantially all of its earnings to shareholders and still grow. BAT's current dividend policy is to pay out 65% of earnings to shareholders. This results in a dividend yield of 5.2%, versus the ALSI's dividend yield of 2.3%. Since 1998, BAT has grown its earnings at a similar rate to the JSE (see Graph 1), despite paying out a far greater share of earnings to shareholders (see Graph 2). BAT's ability to grow profits without the need to retain earnings is a quality the market often overlooks.

In addition, management is good at allocating capital. Following the integration of three recent earnings enhancing acquisitions (Bentoel Indonesia, Tekel Turkey and Scandinavian Tobacco Company), the 65% payout rate is likely to be supplemented by share buybacks, as it was before the acquisitions. Most of BAT's free cash will be returned to shareholders.

An investment in BAT would have outperformed the FTSE by 2% per annum over almost 100 years. The inherent stability that characterises tobacco consumption gives us confidence in BAT's ability to sustain and grow profits irrespective of global conditions. It is seldom that superior quality businesses in stable industries can be acquired at discounts to the average company. BAT provides one such opportunity.